50 people in Business who matter now. Catch the list here

Some stuff that caught me attention:

Rank: 7

The Emerging Global Middle Class:

China, India, Russia, Brazil, and elsewhere

Why They Matter: According to Goldman Sachs, in the next decade, more than 800 million people in China, India, Russia, and Brazil will qualify as middle class -- meaning they will earn more than $3,000 per year. To put the figure in context, that's more than the combined population of the United States, Western Europe, and Japan. These ambitious, well-educated workers represent both a threat and an opportunity for corporate America. On the one hand, thanks to global competition, they're bringing brutal cost pressure to bear on U.S. products. Yet at the same time, these newly affluent consumers have money to spend -- more than $1 trillion a year, according to most estimates -- and they generally aspire to own American brands and other high-quality imports. They're looking forward to enjoying a more comfortable way of life, and huge opportunities await the global firms that figure out how to deliver that at a price these workers can afford.

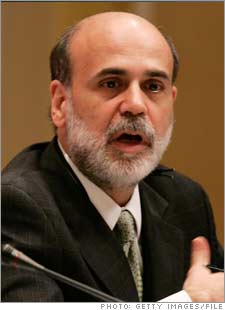

Ben Bernanke

Chairman, Federal Reserve Board

Why He Matters: It may take a few years before economists and Wall Street chieftains stop asking "What would Alan do?" In the meantime, the 14th Fed chief still has a crucial task to perform, and if he goofs, the health of the global economy -- to say nothing of America's technology industry -- is likely to suffer. The concerns are mounting: With inflation creeping upward, the American housing market going soft, and U.S. current-account deficits wildly out of line, will Bernanke be able to maintain the nation's growth while also retaining the confidence of foreign investors and currency traders? We don't envy the position, but this former Princeton economist certainly has no shortage of book smarts. Street smarts, however, remain an open question. A little free advice: It's rude to talk money at the dinner table, but if you do, don't sit next to Maria Bartiromo.

Why He Matters: It may take a few years before economists and Wall Street chieftains stop asking "What would Alan do?" In the meantime, the 14th Fed chief still has a crucial task to perform, and if he goofs, the health of the global economy -- to say nothing of America's technology industry -- is likely to suffer. The concerns are mounting: With inflation creeping upward, the American housing market going soft, and U.S. current-account deficits wildly out of line, will Bernanke be able to maintain the nation's growth while also retaining the confidence of foreign investors and currency traders? We don't envy the position, but this former Princeton economist certainly has no shortage of book smarts. Street smarts, however, remain an open question. A little free advice: It's rude to talk money at the dinner table, but if you do, don't sit next to Maria Bartiromo.

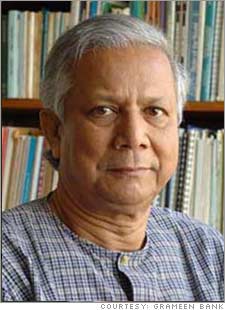

Muhammad Yunus: Founder, Grameen Bank

Why He Matters: By offering tiny loans to Third World entrepreneurs, Yunus isn't just building a healthy stock of karma -- he's inventing a new model for global capital investment. A former economics professor, Yunus had a eureka moment during a trip to a Bangladeshi village, when he discovered that a loan of just 22 cents was enough to help a poor bamboo craftswoman start her own independent business. That prompted him to found Grameen Bank in the troubled country, and he later set about connecting an international network of investors to would-be entrepreneurs who need small-time investments. Grameen has since lent more than $5 billion, at interest rates as high as 20 percent. As a bank, it's even become completely self-financing.

0 Comments:

Post a Comment

<< Home